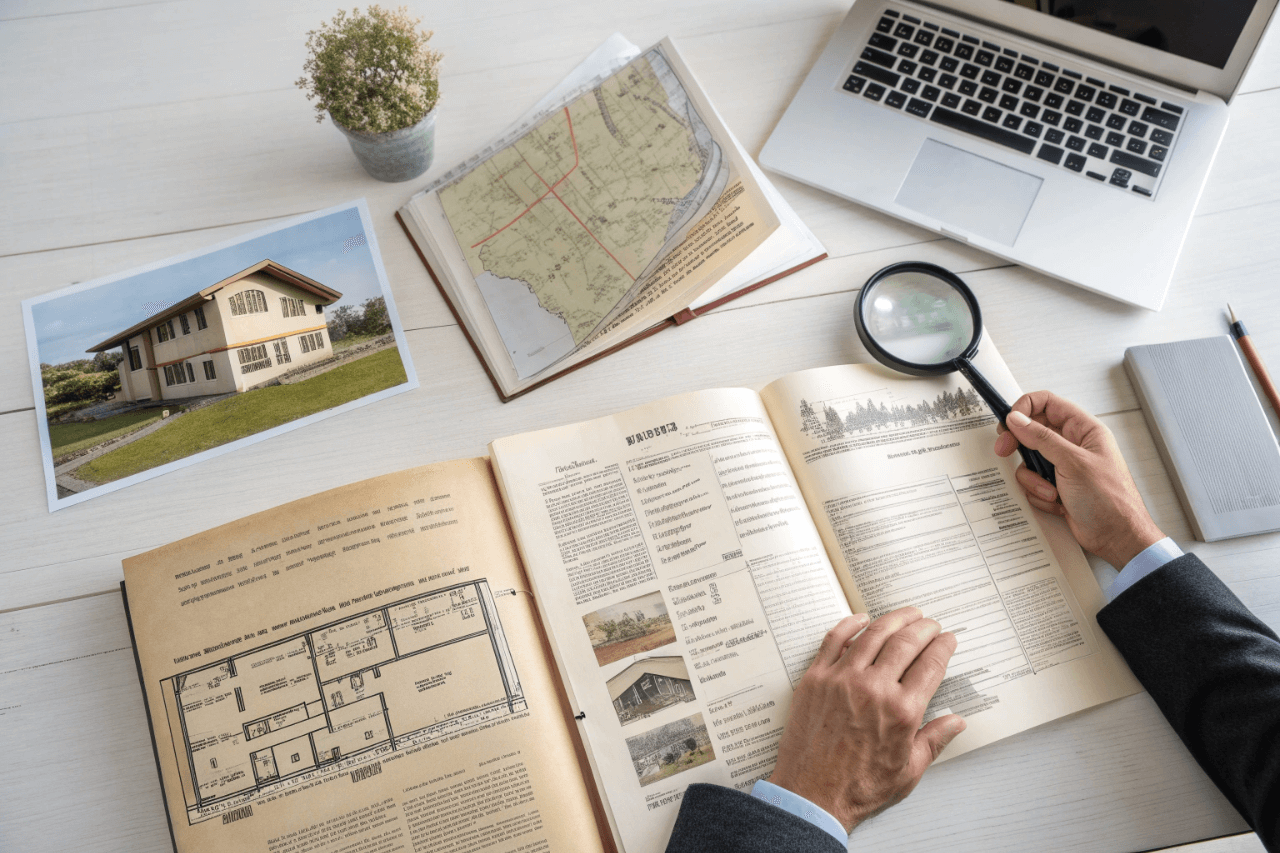

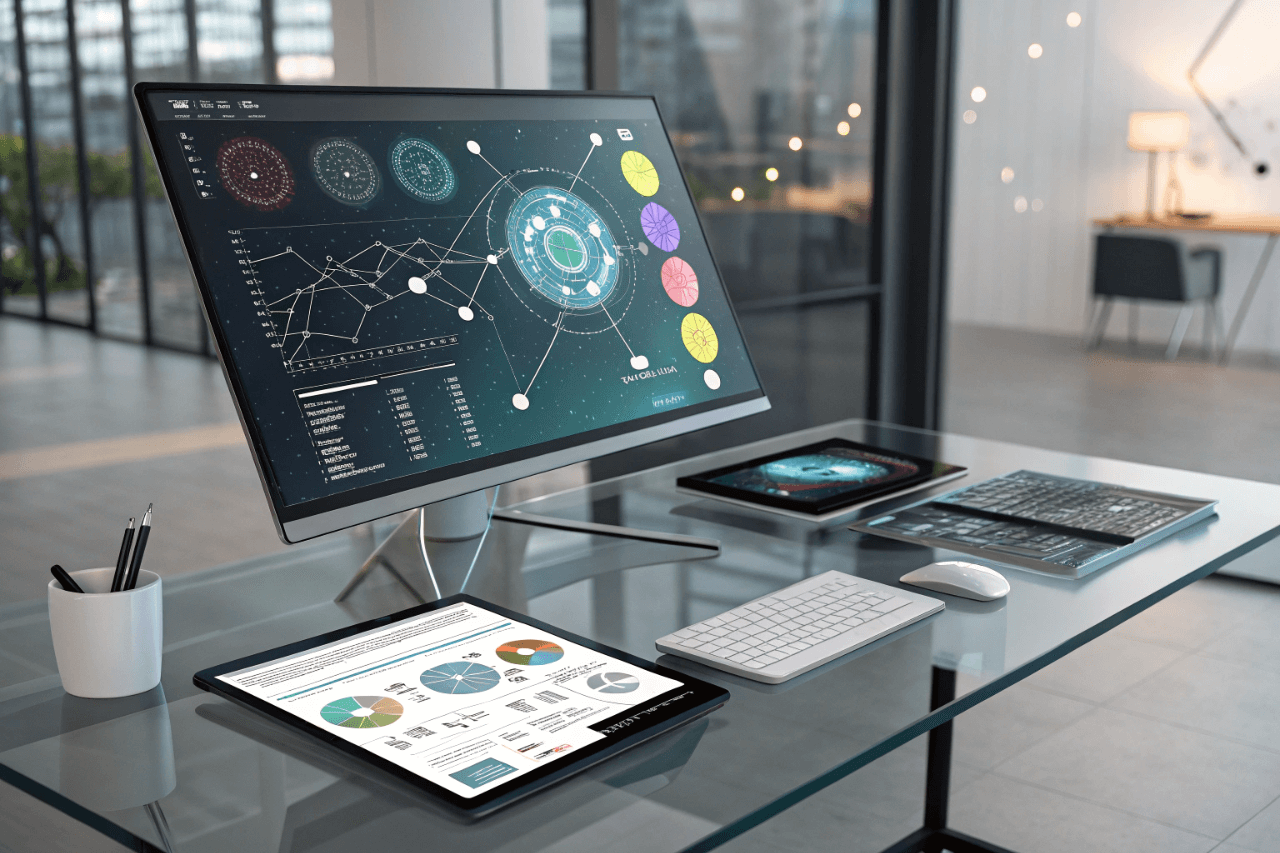

A property title search is a detailed report providing crucial information about a specific real estate asset, such as a home, retail store, office building, or vacant land. This report is essential to verify property ownership and uncover any existing debts or claims, such as mortgages, a property lien search, or other encumbrances that could affect the title's validity. Our comprehensive services include property profile reports and national title reports, offering a full overview of a property's legal standing.

Types of Real Estate Title Searches We Offer

There are several types of title searches tailored to different needs:

- Current Owner Searches: Focuses on the current titleholder and any outstanding liens or encumbrances.

- Two Owner Searches: Extends the search to include the previous owner, providing more historical data.

- 30-Year Searches: Offers a comprehensive title review spanning the last 30 years.

- Last Owner Search: Provides detailed insights about the most recent property owner, ensuring there are no unresolved title issues.

- Commercial Searches: Designed for commercial properties, focusing on unique issues related to business real estate.

- Mortgage and Assignment Searches: Tracks any mortgage assignments or transfers.

- Unrecorded Lien Searches: Identifies liens that may not be officially recorded but still affect the property's status.

Understanding the Difference Between a Title and a Deed

Both a title and a deed prove ownership, but they are not the same. A title is a legal concept that signifies ownership rights, while a deed is a physical document that transfers the title from one party to another and is recorded in county land records to maintain a public record of ownership. When reviewing a deed, it is often beneficial to request property profile reports to validate legal ownership and potential liabilities.

Can You Perform a Title Search Yourself?

While it's technically possible to conduct a title search on your own, the process is intricate and requires a thorough understanding of legal documents, public records, and potential property encumbrances. A property lien search is especially complex, as liens may be recorded at different levels of government, requiring expertise to identify all potential claims. Additionally, a last owner search can be challenging without access to national databases, which professionals utilize for accuracy.

Why Choose ProTitleUSA?

At ProTitleUSA, we are a trusted title research company with over 14 years of experience, serving clients across the United States. Whether you need a full title review, a specialized property lien search, or access to national title reports, our skilled professionals provide fast, reliable, and cost-effective services to ensure your transactions are secure.

Additional Services We Provide

Beyond title searches, we offer a range of related services, including:

- Title Insurance to protect against potential title defects.

- Document Retrieval to secure critical property records.

- Lien Clearance services to help resolve any outstanding property issues.

- Customized Title Reports for specific client needs.

- National title reports for a comprehensive view of property records across different jurisdictions.

Get in Touch with Us

If you're looking for a reliable partner for your title search needs, contact ProTitleUSA today. Our team is ready to assist with any questions and guide you through the process to ensure your property transactions are secure and successful. Whether you need a simple last owner search or a full-scale title investigation, we are here to help.