Property Title Searches in California (CA)

With nearly 40 million residents, California is not only the country’s most populous state, but also the third largest by area. As home to the largest economy in the United States, California’s booming real estate market creates a constant demand for reliable property title search services. Whether you're buying or selling a property, performing a title search in California is a critical step to ensure there are no hidden issues, such as liens or unresolved ownership claims, that could affect your transaction.

What Title Services are Included in a California Title Search?

A California title search for residential or commercial properties includes the following key information:

- Tax and assessment details using the property’s parcel number

- Ownership records via title deeds

- Open deeds of trust and associated documents (including any foreclosure documents)

- Active judgments and liens filed in the county's property records

- Any other documents filed that impact the property

These services ensure that potential buyers or sellers are fully aware of the property’s legal status before completing any transaction. A common point of confusion in this process is the difference between a title search vs title insurance, as both play important but distinct roles in protecting real estate investments.

How Much is a Title Search in California?

The cost of a title search in California varies by the type of search and the county where the property is located. Below are the typical rates:

|

Type of Search |

Cost |

|---|---|

|

O&E Report (Residential) |

$87.95 |

|

Two Owner Search (Residential) |

$137.95 |

|

30-Year Search (Residential) |

$175.00 |

|

Title Update |

$40.00 |

|

Township Search for Unrecorded Liens with Demolition Check |

$75.00 |

|

Mortgage Search |

$50.00 |

PACE Loans and Assessment Liens in California

In California, PACE loans (Property Assessed Clean Energy), as well as other assessment liens, such as the Notice of Special Assessment, are common in real estate transactions. These documents can sometimes appear confusing, leading buyers to think there is a lien on the property for delinquent assessments. However, this is often not the case if the assessment is being collected with property taxes.

To determine if an assessment is part of the property taxes, you can:

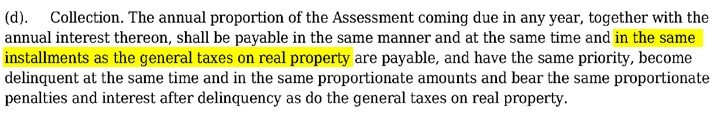

- Read the document to see if it states how the fee is collected. Here is a snippet from an Assessment Lien which states it’s collected “in

the same installments as the general taxes.”

- Look at the tax breakdown to see if a portion of the taxes are going towards the party on the Notice of Assessment. Here is

a Notice of Assessment that was for Hidden Valley Lake Community Services District. You’ll notice the tax bill in the second

snippet shows $92.91 being allocated to HV ASMT DIST. As long as the taxes are current, we can surmise that this is not a true lien on the property.

Trustee Sale Guarantee in California

In California, the Trustee Sale Guarantee (TSG) is an essential component of the non-judicial foreclosure process, providing lenders with crucial details about the property. The TSG includes:

- The legal description and current ownership details

- Records of mortgages or deeds of trust

- Any liens or encumbrances

- The status of property taxes and any bankruptcy filings

- Contact information for parties entitled to receive foreclosure notices

- The approved newspaper for publishing the foreclosure notice

- The specific city or judicial district where the property is located

Foreclosure laws and notification requirements vary from state to state.

California Counties Served

We provide comprehensive title search services across all counties in California, including major regions such as Los Angeles, San Diego, San Francisco, Sacramento, and Orange County. Whether you need a residential title search, commercial title search, or a detailed lien search, we cover all 58 counties, including:

Alameda, Alpine, Amador, Butte, Calaveras, Colusa, Contra Costa, Del Norte, El Dorado, Fresno, Glenn, Humboldt, Imperial, Inyo, Kern, Kings, Lake, Lassen, Los Angeles, Madera, Marin, Mariposa, Mendocino, Merced, Modoc, Mono, Monterey, Napa, Nevada, Orange, Placer, Plumas, Riverside, Sacramento, San Benito, San Bernardino, San Diego, San Francisco, San Joaquin, San Luis Obispo, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, Shasta, Sierra, Siskiyou, Solano, Sonoma, Stanislaus, Sutter, Tehama, Trinity, Tulare, Tuolumne, Ventura, Yolo, and Yuba.

Frequently Asked Questions

From Customers in California

How long does a title search take in California?

Testimonials

“Great service, very reasonable prices, fast turnaround, excellent communication.”

“Very happy I found them! I will be using them again in the future.”

“Very quick & accurate. I use ProTitle on all my real estate note deals!”