Find the History of Your House with a Complete Historical Property Search

A comprehensive property history lookup gives you a clear picture of what truly stands behind a property before money changes hands. If you want to find the history of your house, this report helps uncover what standard listings often do not show. Past ownership disputes, unpaid liens, tax trouble, or legal claims can hide behind an attractive façade. Thousands of real estate transactions every year are delayed or canceled because of undiscovered title issues. This service helps buyers, investors, and professionals avoid expensive surprises by revealing verified background data in one structured report.

It acts as a powerful home history search tool, digging through public records to help you review real estate documents, deed transfers, and ownership records tied to the specific address. By aggregating data from multiple sources, we provide a timeline that reveals the financial and legal reality of the property.

Understanding a House Sale History and What It Reveals

This type of house history search is based on deep-dive official records, going far beyond a simple "current owner" check. A robust historical property search looks at how ownership changed over time, what legal actions may have occurred, and whether financial or legal risks are inherited with the land. Think of it as reading the full biography of a property rather than just its latest chapter.

In other words, it helps you look up the history of a house confidently using documented sources such as county records, deed registries, and court filings. Many hidden problems—like liens, judgments, or unresolved foreclosures—do not appear during a standard home inspection because they are legal matters, not physical defects. For buyers comparing options, reviewing the home sale history can reveal patterns (like rapid flipping or repeated foreclosures) that signal risk, supporting better property due diligence.

Who Can Benefit from Reviewing a Property’s History

This service is not only for buyers. Anyone with a financial or legal interest in property history can benefit from a deeper look at past records and ownership behavior. It acts as a protective layer for both individuals and businesses involved in real estate decisions, effectively serving as a reliable house history finder for those who need a clear property background overview.

People who commonly rely on these comprehensive reports include:

- Homebuyers purchasing resale or inherited homes

- Real estate investors targeting rental or flip properties

- Buyers of foreclosed or distressed assets

- Landlords expanding their portfolios

- Legal and financial professionals involved in property transactions

Even sellers use history reports to confirm their listing is free from unresolved claims. Transparency builds trust and can speed up negotiations. In many cases, sellers also verify the house sale history to support accurate disclosures and justify their pricing strategy.

What Information Is Typically Included in a Property History Report

A reliable property history lookup report combines multiple public data sources into one readable document. It presents facts, not assumptions, allowing you to evaluate risk with confidence. Think of it as a structured file built from property records, tax archives, and ownership history sources.

Below is a quick breakdown of the most common sections included in a house history search report and why they matter for due diligence:

| Report Section | What It Covers | Why It Matters |

|---|---|---|

| Ownership History | Previous owners, deed transfers, and transaction timeline | Helps spot unusual transfer patterns, potential disputes, or gaps in the chain of title |

| Liens & Mortgages | Open and released liens, recorded mortgages, encumbrances | Identifies financial claims that can delay closing or reduce equity |

| Property Tax Status | Tax payment history, delinquencies, and potential tax trouble | Prevents surprise balances, penalties, or tax sale risk in some jurisdictions |

| Foreclosure & Court Records | Foreclosure history, court filings, and recorded legal actions | Reveals legal red flags that may affect marketability and timing |

| Bankruptcy Mentions | Bankruptcy references connected to ownership periods (where available) | Provides context for past financial distress and possible complications |

| Permits & Violations | Permit history, known violations, compliance-related entries (where available) | Highlights potential unpermitted work, enforcement risks, or repair costs |

Beyond listing data, the value lies in context. Seeing how frequently a property changed owners or whether liens were consistently resolved can reveal patterns that raise or lower risk. It helps verify the home sale history across ownership periods when those records are accessible, highlighting judgment records and other encumbrances.

Comparing a Property History Review, Title Search, and O&E Report

A house history search is often confused with other property research services, but it serves a broader purpose. A title search focuses mainly on establishing legal ownership and lien priority for insurance, while an O&E report concentrates on the current owner and existing encumbrances.

A comprehensive history search expands the scope by connecting past and present. It helps answer questions like why a property transferred ownership multiple times in a short period or whether financial trouble followed previous owners. This wider perspective supports smarter decisions. For many buyers, it functions like a practical house history finder built around recorded evidence such as deed history, chain of title, and title chain continuity.

| Feature | Property History Lookup | Title Search | O&E Report |

|---|---|---|---|

| Ownership History Review | Full historical review | Yes | Limited |

| Closed & Released Liens | Included | Included | Partial |

| Foreclosures & Bankruptcies | Included | Limited | No |

| Property Tax History | Included | Yes | Yes |

| Risk Indicators & Red Flags | Yes | Some | No |

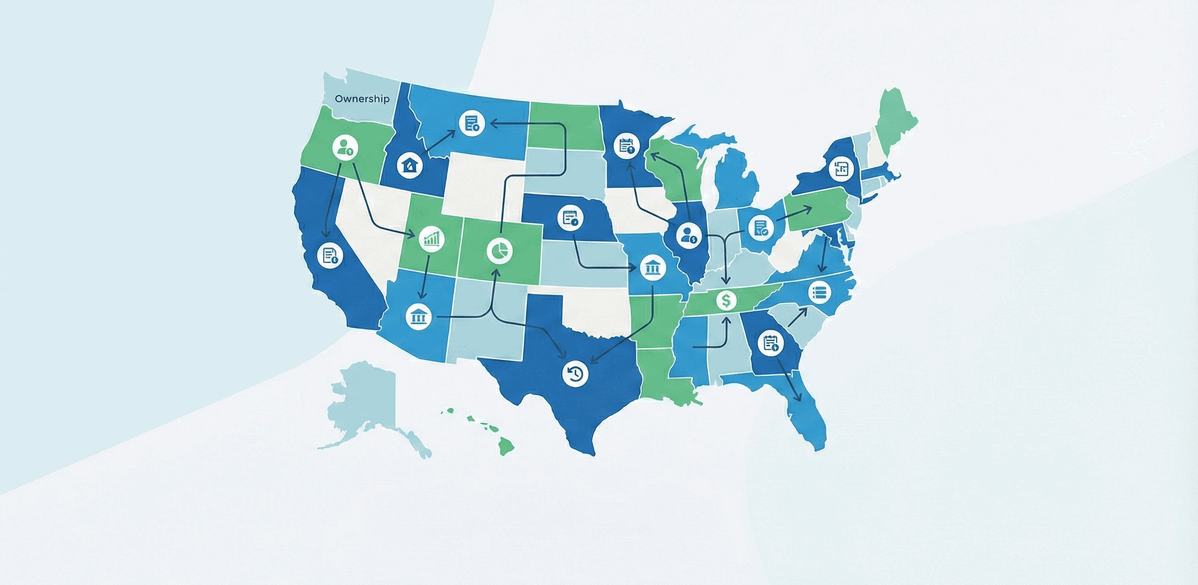

How Property History Research Is Conducted

From a customer standpoint, the experience is about gaining insight, not navigating complexity. Data is gathered from recorded sources such as county recorder systems, county clerk archives, court systems, and tax authorities. This makes it easier to run a home history search or a historical property search without digging through multiple government portals yourself.

What matters most is accuracy and coverage. Reliable checks pull information from multiple jurisdictions when needed, ensuring ownership chains and legal events are not overlooked. This level of review is especially important for properties with long histories or changes across decades.

Why Our Property History Research Stands Out

Not all property history services offer the same depth. If your goal is to find the history of your house accurately, the key is having consistent sourcing and clear interpretation from public records. Working with ProTitleUSA means gaining access to verified public records combined with industry knowledge.

The result is a report designed for real-world decisions, not just raw information. It supports accurate property history review needs, ensuring you understand the complete narrative of the real estate asset.

Common Questions About Property and House History Reports

How far back does a property history report go?

Can I look up the history of a house to see past sales?

What information do I need to order?

Order a House History Search Today

When you’re about to invest in a property, uncertainty can be expensive. This kind of property history lookup gives you solid facts you can trust, so you’re not relying on assumptions. Instead of wondering what may have happened years ago, you receive clear, documented insights. If you want to look up the history of a house before buying a home, this is one of the most practical ways to do it.

With ProTitleUSA, you’re partnering with a team that understands how property history impacts real financial decisions. Our research is built on verified public records to help you minimize risk. Order your house history search today and make your next move backed by facts, not guesswork.